Are yours looking to get the most suitable business insurance plan in Ontario? Look no further. We help it easy to review quotes from leading insurance providers, so get more info you can discover the perfect policy for its requirements. Don't waiting any further to insure your business. Get started today and get your free quotes now!

Oshawa Brokers Go Big: Expanding into Commercial Insurance

Oshawa-based Firms are making waves in the industry with a bold new move: expanding their services to include commercial insurance. This strategic decision comes as businesses across the region face growing risks and demand comprehensive coverage solutions.

Oshawa Brokers have always been known for their expertise to providing individual insurance, but now they are going a giant leap forward by entering the complex world of commercial insurance. Our team of seasoned brokers is thoroughly trained in navigating the unique needs of businesses of all shapes.

With a robust range of coverage options available, Oshawa Brokers are equipped to become the go-to resource for businesses seeking trustworthy insurance coverage.

Comprehending Rough Commercial Insurance in Ontario

Navigating the complex world of insurance can be a challenge, especially when it comes to rough commercial coverage. In Ontario, this type of policy extends crucial protection for businesses operating in high-risk industries or facing unique exposures.

Rough commercial insurance helps mitigate financial losses resulting from accidents that may be unexpected and often involve significant damage or liability claims. Understanding the key features of this policy is essential for Ontario businesses to ensure they have adequate coverage in place.

Finding Ontario Business Insurance Premium Quotes Made Easy

Navigating the world of business insurance can be a daunting challenge for Ontario entrepreneurs. From determining the right coverage to understanding policy terms, it's easy to feel overwhelmed. However, acquiring accurate and competitive premium quotes doesn't have to be a difficult process. A variety of online resources now make it straightforward to compare quotes from various insurance providers, allowing you to find the best option for your unique business needs.

- Utilize online comparison tools:

- Request quotes from multiple insurers:

- Analyze your coverage options carefully:

By taking a proactive approach and employing these tools, you can streamline the quote process and obtain the optimal insurance coverage for your Ontario business.

Protect Your Business: Get a Customized Ontario Quote

Running your business in Ontario requires meticulous planning and protection. Simply leave your enterprise vulnerable to unforeseen risks. Secure a customized quote from our company today and find out how our experts can support you in reducing your liability.

- Our diverse selection of insurance programs tailored to address the specific requirements of Ontario businesses.

- Receive cost-effective quote in a flash.

- Reach out to our knowledgeable team today for a free consultation.

Top Commercial Insurance Providers in Ontario

Ontario's thriving business landscape demands reliable and comprehensive commercial insurance coverage. To help navigate your search for the perfect fit, we've assembled a list of some of the top providers in the province.

These providers offer a wide variety of policies tailored to meet the unique needs of Ontario businesses.

From property and liability insurance to niche coverage for industries like construction, these providers are committed to helping your business prosper.

ul

li AIG Canada

li Economical Insurance

li Aviva Canada

li Intact Financial Corporation

li Sun Life Financial

li HUB International

li RSA Canada

li The Co-operators

li Chubb Limited

li Wawanesa Mutual Insurance Company

It's essential to assess quotes from multiple providers before making a choice. Don't hesitate to ask questions and confirm you understand the terms of any policy before signing.

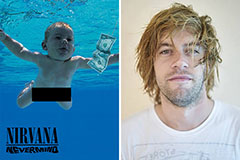

Luke Perry Then & Now!

Luke Perry Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!